Track Your Mileage, Receipts, & Expenses Automatically. Oh, And Its Actually Designed To Protect You In An IRS Audit!

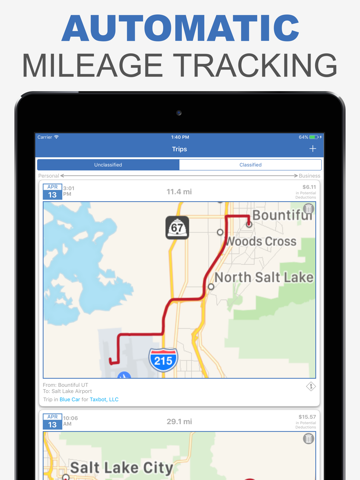

AUTOMATIC MILEAGE TRACKING

Taxbot tracks all your driving in the background so you dont have to remember to do it. Later, you can easily identify and classify your business trips. Each trip card displays:

-Detailed map highlighting the exact route taken

Full addresses (not just a city)

-Easily merge trips

-Trips ending within 30 minutes of an event on your calendar will suggest the purpose of the trip to help identify it.

Simply swipe personal trips left and business ones right.

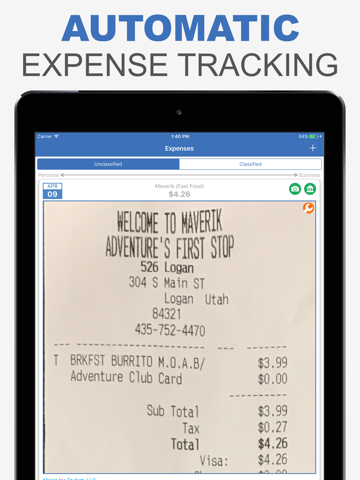

SMARTMATCH RECEIPTS TO EXPENSES

Your Only Job -- Snap pictures of physical receipts (Takes about 1 second). Your email receipts can automatically be imported with your permission.

Taxbot Takes Over -- The app reads the receipts using OCR (optical character recognition). When the bank or credit card charge shows up in your bank account a day or two later, Taxbot will:

-Match photo and email receipts to the correct bank transactions

-Fill in missing data*

-Categorize the expense

-And Send it back to you for your approval!

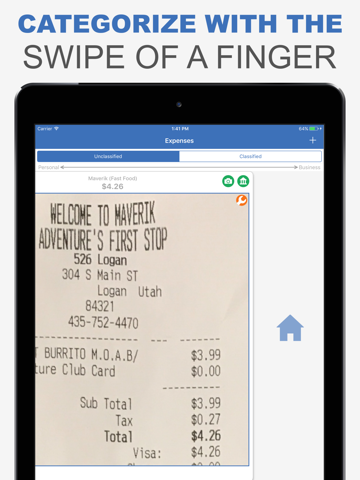

Simply swipe personal expenses left and business ones right!

*If an expense or trip needs additional information to be tax compliant the card will flip and ask you for the information.

RECREATE YOUR PAST WITH SMARTMATCH

Signing up mid-year?

-Upload past bank statements

-Snap pictures of the receipts stuffed in your shoebox

-Wait 15 minutes and your receipts will be matched and ready for review.

DESIGNED BY AN IRS ATTORNEY TO BE BULLETPROOF AGAINST AN AUDIT

The IRS wins in 83% of audits. The primary reason is not cheating... It has to do with poor record-keeping. The IRS can ask you to prove your deductions with things like:

-Copies of receipts and invoices for almost every expense (very few exceptions)

-A written log for "meals" expenses that detail who you met with and the business discussion

-A mileage log for that includes the reason for each drive.

Unfortunately, most accounting programs are not designed to make sure you have the proper proof in case of an audit.

EASY REPORTS YOUR ACCOUNTANT WILL LOVE

Amaze your accountant with our AuditSafe Reports which include:

-A complete Profit & Loss Statement.

-Pictures of all your receipts along with IRS required information printed below each photo.

-Detailed mileage log with all the proof you need

Now if you get audited you can hand the auditor your report with confidence!

Simple Set Up - Easy To Use

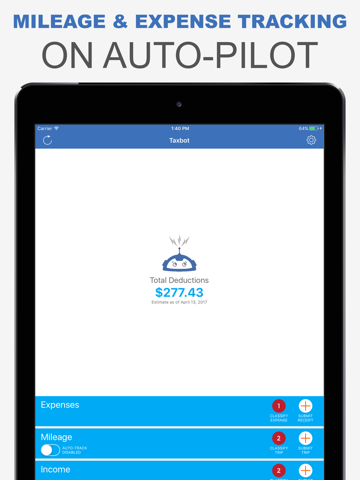

100X RETURN ON INVESTMENT

On average Taxbot customers track and save over $10,000 in taxes... Not bad considering Taxbot is only $8.33 per month (when billed annually). And even that is tax deductible too!

If you have any questions or problems please call us! We actually have a customer service department! 855 -4-Taxbot (855-482-9268)

A monthly or annual subscription is required to use Taxbot. Your Taxbot subscription will automatically renew each month for $9.99 or annually for $99.99 and your credit card will be charged through your iTunes account.

You can turn off auto-renew at any time in your iTunes account settings. Your subscription will automatically renew unless auto-renew is turned off at least 24 hours prior to the end of your current billing period. Your account will be charged for renewal within 24 hours of the end of your current period. Please go to https://taxbot.com/terms/ for information regarding our terms of service and our privacy policy.

*Note: Because trip tracking uses the GPS in your phone we recommend plugging your phone in while driving to help with battery usage. When you are driving we use highly accurate GPS points so we can give you an actual map of your route. While driving, Taxbot will use battery equivalent to other navigation or GPS enabled apps. Continued use of GPS running in the background can dramatically decrease battery life.

TRY IT RISK FREE FOR 14 DAYS!